Ford F-150/F-250: Insurance Guide

We will walk you through the process of getting the best deal when insuring your Ford F-150 or Super Duty.

This article applies to the Ford F-150 (2004-2014) and F-250, F-350 Super Duty (2005-2014).

Owning a Ford truck is a substantial investment. While insurance is a necessity, sometimes it can feel like you’re getting the short end of the stick. Insuring a truck involves more factors than a regular automobile. The mere size, weight, and payload of the truck guarantees more damage will occur in a collision. Your Ford F-150 or Super Duty truck may show little or no damage, but the other vehicle could be extensively damaged. Other important considerations are: the truck dimensions increase blind spots, intense vehicle usage causes wear and tear (especially for tires), trucks are often used to pull other recreational vehicles, and truck usage can result in scratches, dents and broken lights. Traditionally, insurance only covered physical damage and bodily injury. However, today’s insurance is much more focused on personal protection; it can even protect against the theft of your vehicle.

Top 10 Auto Insurance Companies in America (2014)

With well over 100 auto insurance companies in the country, choosing one that is not in the top ten doesn't mean it's not good. Compare your company to those that are on the list below to see how they compare:

| Company | Overall | Claims Processing |

Customers Who | Coverage | Financial Strength Ratings |

|---|---|---|---|---|---|

| USAA | 93.9 | 4.5/5 Stars | 83% |

|

A++ |

| State Farm | 92.7 | 4.5/5 Stars | 81% |

|

A++ |

| Farmers | 91.5 | 4.5/5 Stars | 74% |

|

A |

| GEICO | 91.1 | 4.5/5 Stars | 75% |

|

A++ |

| Auto Club of So California | 90.5 | 4.5/5 Stars | 81% |

|

A+ |

| Nationwide | 90.5 | 4.5/5 Stars | 76% |

|

A+ |

| Liberty Mutual | 90.2 | 4/5 Stars | 74% |

|

A |

| AllState | 90 | 4/5 Stars | 78% |

|

A+ |

| American Family | 89.5 | 4/5 Stars | 76% |

|

A |

| The Hartford | 89 | 4/5 Stars | 76% |

|

A |

For more details and explanation of the data presented in this table, please see Customer Satisfaction Ratings at Insure.com.

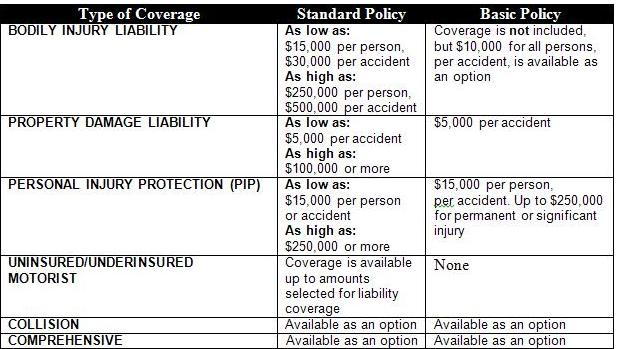

Types of insurance can vary and be very specialized, but basically insurance is divided into two categories: Bodily Injury and Liability Insurance. Bodily Injury insurance protects the insured against a lawsuit from an injury or death. States differ as to the compulsory amount required for this type of insurance. For instance, California, Nevada and the western states require 15,000, but the eastern states require more. The second type of insurance is protection insurance called Liability Insurance. This is the amount paid to the victim for property damage. Liability insurance will carry a deductible the insured must pay in order to compensate the victim. The deductible will be paid to the garage, or organization fixing the victim’s vehicle. For a truck owner, more liability insurance is a wise choice. Since a truck collision generally causes more damage, more liability will make sure the truck owner does not have to pay extensively out-of-pocket. In California, liability insurance is a 5,000 minimum. In Nevada and Colorado, it is a 10,000 minimum.

Insurance rates rely on many elements to determine the cost of the policy, several of which can benefit the insured. First and foremost, vehicle performance, capability, and retail cost determine the initial part of the policy. However, modern insurance will reward the insured for low points on their license, a good credit rating, good driver discounts, good student discounts, low yearly mileage, and more. If the insured plans on keeping the vehicle for a long while, he or she can purchase auto repair insurance that will cover major mechanical problems, like a bad transmission.

Related Articles

- How to Off-Road - Ford-Trucks.com

- Crash Test and Safety Ratings - Ford-Trucks.com

- Basic Maintenance Schedule - Ford-Trucks.com

So how do you go about insuring your truck?

Step 1 - Determine how much insurance you can afford

It is important to roughly know how much you want to pay for your insurance. The cheaper you go, the more benefits you might have to compromise.

Step 2 - Evaluate the use of your vehicle

It is crucial to consider how you are going to use the truck. Is it an everyday vehicle or a truck used just to pull your camper or boat? How old is the truck and do you plan on keeping it, or trading it in? Are you OK with the vehicle having a few scratches and dents?

(Related Article: How to Hitch a Fifth Wheel - Ford-Trucks.com)

Step 3 - Do your research

There is a saying, “You get what you pay for.” Finding a reliable insurance company known for taking care of their customers is key to your peace of mind. Ask your friends, colleagues, and family their advice. Interview several insurance agents before making your choice. Look into the special incentives and benefits different companies offer. Some will give you discounts for a good driving record.

Insuring your truck doesn’t have to be a bad experience, but it is one that is crucial for your future. Taking the time out to review all your options will definitely help you feel safer on the road!

Related Discussion

- Insurance - Ford-trucks.com